The innovator’s dilemma, across industries, is that in order to become great, a company has to do many things right. It must listen to its customers, direct its investments to the highest-return opportunities, improve the quality of its products, manage its relationships with suppliers, correctly assess and cope with competitive threats, all amongst many other time and resource consuming activities. Sometimes, however, doing everything right and, thus, moving too far up the market chain can lead to failure, especially in the financial services industry.

Let’s first take a step back and put financial services companies in context. Like every company, these firms exist as part of a value network. They create products and services, sell them to customers, incur costs, and compete in the context of their specific value network. Typically, they all measure quality and performance in an extremely similar and often identical way.

For example, in today’s digital world, these companies may place the same emphasis on technical excellence or service quality. They often have comparable performance and profit margins. Their capabilities usually suit them to working within their specific value network and make it difficult for them to work in a different value network. Their cost structure allows them to make money at one level of margin, but not at another.

How Disruptive Financial Innovations Disrupt

There are two kinds of innovations:

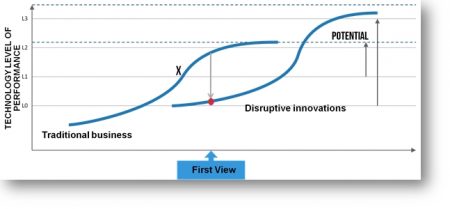

- Disruptive innovations– these innovations improve existing products and offer better performance against established, mainstream metrics.

- Sustaining innovations– these innovations typically offer less performance than established products, but are smaller, easier to implement and cheaper.

Disruptive innovations cause problems for established financial companies because they change the value proposition. They usually find their first market foothold among the least profitable segments of the market, or among people for whom a cheap, substandard product is better than nothing, such as the unbanked, underbanked, or the digitally-savvy cost-conscious consumer segment looking for an alternative to existing banks.

The new disruptive financial innovations establish, as it were, a new value network. Ironically, those who discover disruptive innovations are usually the employees of established companies whose ideas go unreported, unnoticed or unappreciated; hence unacted upon. This is because their novel ideas seemingly make little or no sense within the context of the long-established financial services value network.

Justified Neglect?

Financial companies that ignore disruptive innovations do not do so because they are poorly managed, out of touch with mainstream customer realities or unable to prioritize investments correctly. They ignore disruptive innovations precisely because they do not have these faults.

Disruptive innovations typically offer lower quality in the exact product/service traits that the typical customers value, and they promise lower profit margins to the provider. It makes little sense for a legacy company to invest in an innovation that its customers do not want and on which it cannot make its usual returns. Thus, when such a company chooses to ignore a disruptive innovation, it is making a perfectly rational choice – a good business decision. Only with hindsight will it prove disastrous.

Leveraging Feedback and Ideas

Typically, when an established financial company encounters a disruptive innovation, it tells its most important customers what it has found and asks for their feedback. But because the innovation offers less quality than the existing products, mainstream customers have no use for it.

For example, banks’ most loyal, long-term customers belong to a generation that tends to prefer traditional wire transfer over alternative methods, or prefer in-person advice over robo-advisors. Hence, these people provide only a limited window into the wider market reality.

The company thus goes on to refocus its efforts on improving quality in the dimensions that the loyal customers value. Often, the company improves the existing product so much that it outstrips the market’s needs. Technology supply exceeds technology demand, and further quality improvements become irrelevant to customers.

Meanwhile, precisely because of these efforts, a vacuum opens at the low end of the market, where less demanding, more price-conscious customers are forced to buy more functionality and performance than they need. So instead, they choose to stay away from that product and look for alternatives. Disruptive financial innovators fill this vacuum with new types of payments and remittances, reg-techs, insur-techs, digital banks, alternative currencies, and more.

This is why good innovation management is so important for all companies. With a comprehensive custom idea management platform, financial institutions can gather better customer intelligence, reach digitally-savvy generations, encourage intrapreneurship within the company, and improve processes.

Discover how Steinbeis and Qmarkets are helping financial organizations across the globe to develop the disruptive innovation strategy that will best serve them in an increasingly competitive market. With speakers from Unicredit & Airbus, the Frankfurt Finance Innovation Leader Tour will cover all of this and much more – click here to request a complimentary ticket to attend!

As an expert in the field of Digital Finance, Ralf has accumulated more than 25 years of experience as CFO and innovation manager at global leading global companies such as Colgative-Palmolive, Staples, Bruker, Henry Schein. Most recently Ralf has shared his expertise as a Lecturer of Finance at the University of Applied Science in the Hamburg.